Choosing an insurance provider depends on its reliability and effectiveness of handling, processing, and claims–claim settlement ratio. Prospective holders look for a high claim settlement ratio to understand if the insurer is successfully paying claims.

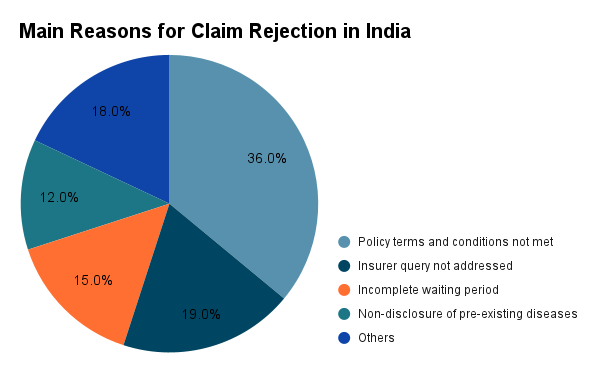

Health insurance acts as a financial cushion, offering protection against high medical costs, especially in times of emergency. However, some have to go through the frustration of claim rejection. Out of all claims rejected by insurers, 75% are due to a limited understanding of the policy and non-disclosure of pre-existing diseases. OPD and daycare claims that are not covered amount to 9% of claim rejections and 19% due to not answering insurers’ queries.

Reasons for Claim Rejections

Policyholders have also faced challenges while filing claims, getting their claims rejected or only partially approved. In the last three years, 43% of policyholders struggled to process their claims. Most of the claim rejections are due to not meeting policy terms and conditions, non-disclosure of pre-existing diseases, not answering insurers’ queries, and incomplete waiting period.

These issues emphasise the importance of transparent and responsible communication between the insurers and the policyholders. Moreover, it is crucial to understand various factors that lead to claim rejections so that you can avoid the pitfalls.

Non-disclosure of Pre-existing Diseases

One of the main reasons for claim rejection is the non-disclosure of pre-existing conditions, which accounts for 12% of rejections. Do inform your insurance provider about any existing medical condition or ailment at the time of purchasing the policy. The insurer can reject your claim if you fail to do so and they discover it later.

Non-Covered Services and Policy Exclusions

Another major factor in claim rejections is claims for treatments and conditions not included in the policy. These claims include non-covered ailments and excluded services such as OPD and daycare. 36% of claim rejections in India resulted from not meeting policy terms and conditions. You need to understand the policy terms and conditions to avoid such inconveniences.

Delay in Claim Submission

Claim submission must be done before the deadline provided by the insurer. If you fail to do so, the insurer can reject your claim request. Such delays could result from a misunderstanding of the stipulated time or delays in administrative procedures to procure necessary documents.

Inadequate Network Hospitals

Every insurer has a network of hospitals. It is necessary to have the treatments done in these hospitals. Or else, the insurer can reject your claim. Thus, it is important to check for hospitals in the network list beforehand or keep an eye on the insurer’s network status. The claims can also be rejected if the hospitalisation does not align with the policy criteria.

Raising Claims During the Waiting Period

Health insurance plans come with waiting periods, ranging from an initial waiting period to a waiting period for pre-existing conditions. 15% of the claims were rejected because they were filed during the waiting period. If you file your claim within the waiting period, the insurer can reject it.

Incorrect Diagnosis

An incorrect diagnosis of the illness can be a reason for claim rejection. The insurer can reject your claim if the diagnosis does not match the medical records. The reason for such issues could be mistakes in treatment and procedure codes entered by healthcare providers.

Incorrect Information on the Claim Form

Errors in the claim forms can lead to claim rejections. You need to fill out the form with accurate information about the required details, such as name, age, phone number, policy name, name of illness, etc. In addition, the insurer can deny your claim request for incomplete submission due to missing necessary documents. Make sure you submit the right medical reports, bills, and discharge details.

Missed Pre-Authorization Requirements

Some health insurance plans require pre-authorization for certain treatments and surgeries. If you fail to obtain approval from the insurer, it can be a reason for claim rejection. It is also possible that pre-authorization gets overlooked in emergency cases. So, be wary of such conditions.

Lapsed Health Insurance Policy

If your health insurance plan has lapsed, your claim will be rejected. Usually, policies lapse if you fail to pay premiums within the due date or grace period. In such cases, you will not be eligible to claim the medical coverage. So, make sure the premiums are paid on time.

Exhaustion of Sum Insured

Surprisingly, the sum insured also plays a significant role in claim rejection. Every policy has a sum insured limit for a year. If you exhaust this amount, your insurer can reject the claim. Some of the reasons that can lead to complete exhaustion of the sum insured are repeated hospitalisations and several high-cost treatments for people with severe health issues.

How to Avoid Claim Rejection

- Maintain transparency with your insurance provider and have an open communication.

- Before seeking any treatment, review the policy and verify what expenses are covered.

- While filing a claim, provide accurate information and double-check all personal details.

- Pay extra attention to maintaining documents such as medical bills, invoices, and prescriptions.

- Know the deadlines and file your claim promptly.

- Check for pre-authorisation conditions for certain treatments and procedures.

- Make sure you thoroughly understand the policy terms and benefits, and check if there have been any changes during renewal.

Things to Do After Claim Rejection

Many might not know what to do when their claims get rejected. Here are a few steps you must follow.

Step 1: Study and understand the reason.

Step 2: Identify if there is any wrong information or missing document, and make necessary changes.

Step 3: Contact the insurance company to check if the changes are adequate, and refile your claim.

Step 4: If you still face difficulties in doing so, contact an Ombudsman to assist you in the claim settlement.

Step 5: You can also draft an appeal to the insurance company, for which the policy already provides the protocol.

Understanding the causes of claim rejections can help take preventive measures to avoid such frustrating situations. It can be helpful to have intermediaries, such as insurance agents, for assistance filing claims. While having agents has a higher success rate than filing individually, online intermediaries are proven to be more beneficial than offline agents. Take all the assistance you require and maintain transparency with your insurer to get your claims approved smoothly.